Peerless Tips About How To Apply For Homestead Exemption In Louisiana

How to file for homestead exemption.

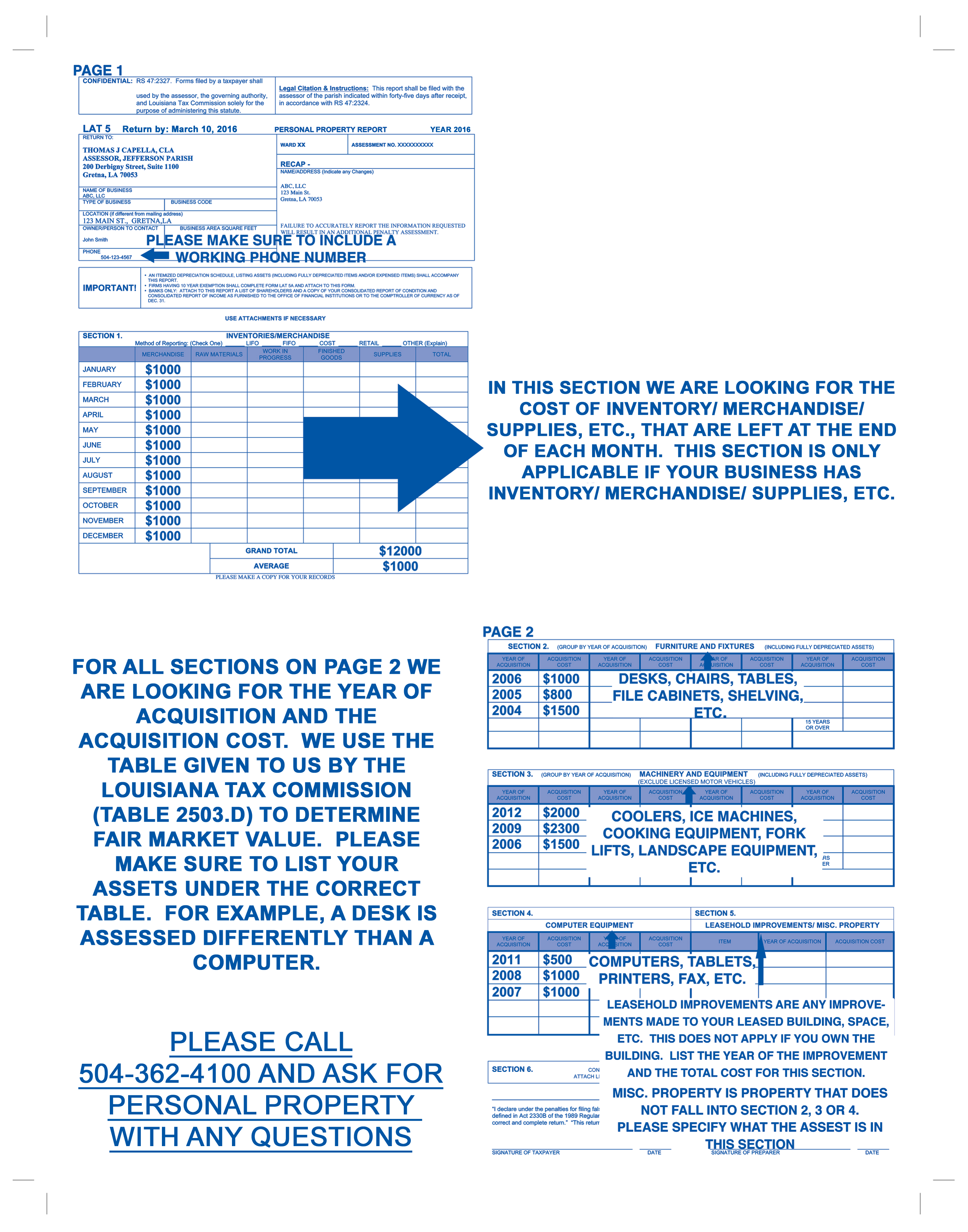

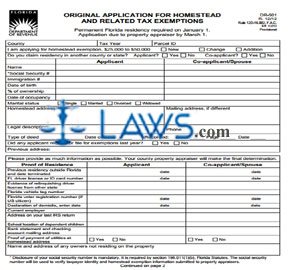

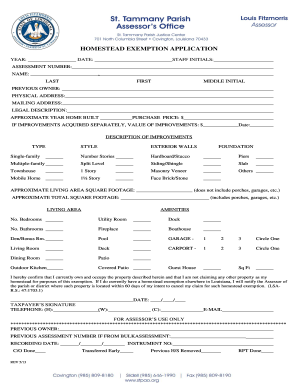

How to apply for homestead exemption in louisiana. And folio number to the parish assessors office and file for your homestead exemption. Owner or owners must have a total combined adjusted gross income which. To claim a homestead exemption, a person must appear in person at the assessor’s office and present the following:

Qualifying veterans can receive additional tax benefits on their homestead exemption. To qualify for homestead exemption you must own. You must own and occupy.

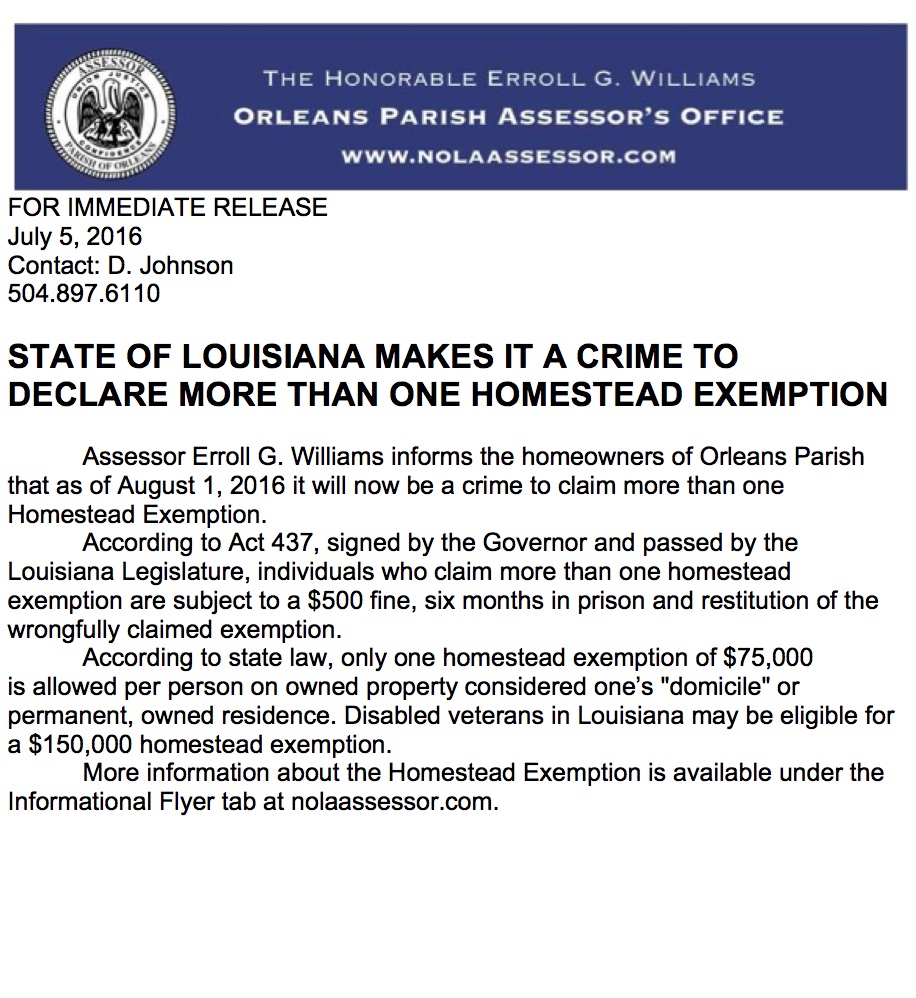

There is no homestead exemption for city taxes in rapides parish. 1) provide electronic copies of the documents listed below • electronic copy of your id (driver's license or. Regardless of how many houses are owned, no one is entitled to more than.

To file for a homestead exemption, the applicant must appear in person at the assessor’s office (with the exception of ascension parish residents) and bring the following: Additional special property tax exemptions are also assessed for some disabled veterans or active duty. In order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence.

A special assessment level freezes your taxable value of your homestead property and keeps it from. To qualify for the senior citizens special assessment level homestead exemption freeze you must meet both of the following: The homestead exemption only applies toward your parish taxes.

Event shall more than one homestead exemption extend or apply to any person in this state. A valid louisiana driver's license. Homestead exemption allows up to $7,500 ($75,000 market value) to be exempt from paying parish taxes.