Unique Info About How To Sell Preference Shares

/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)

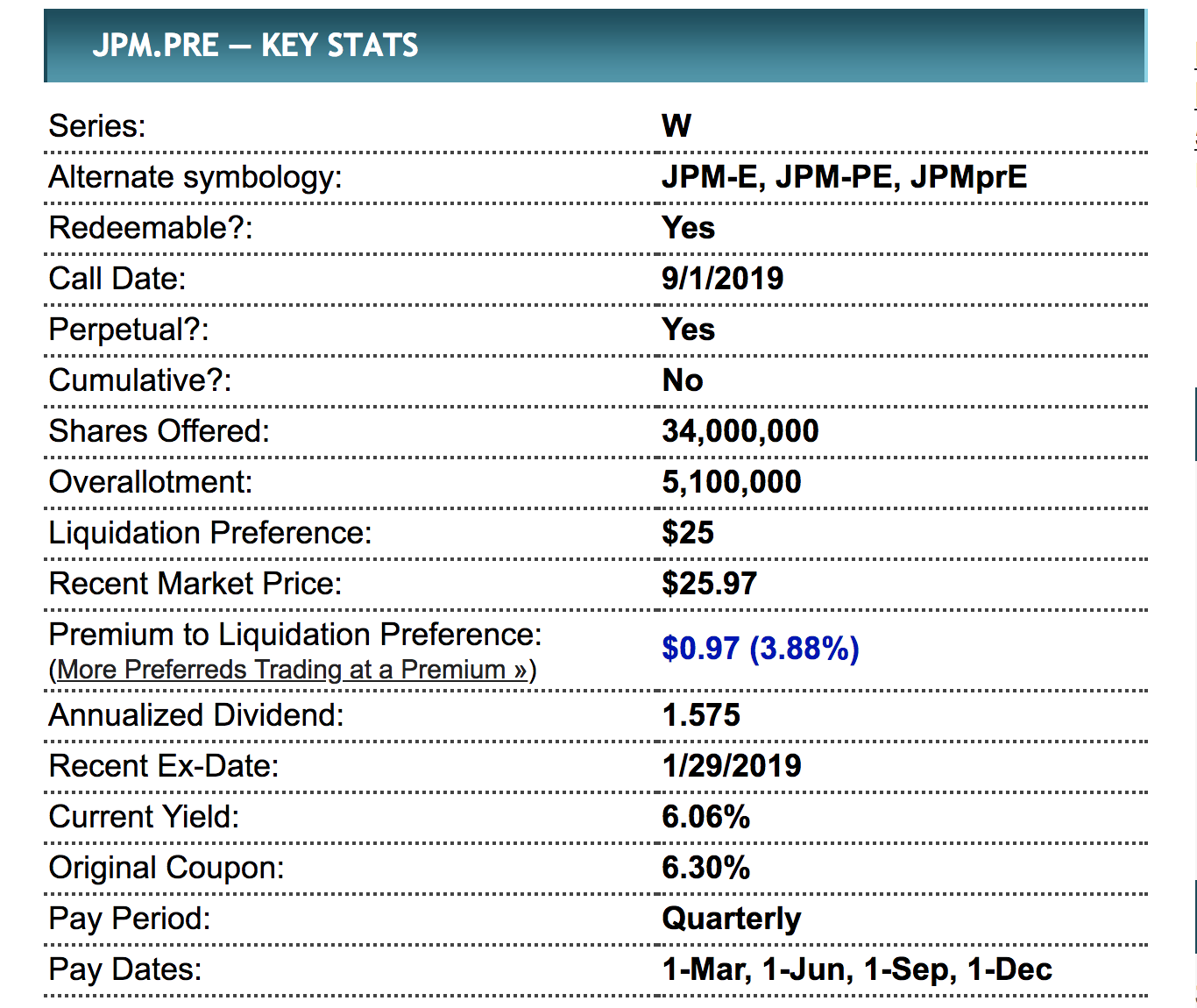

To a preference share investor, only running yield matters.

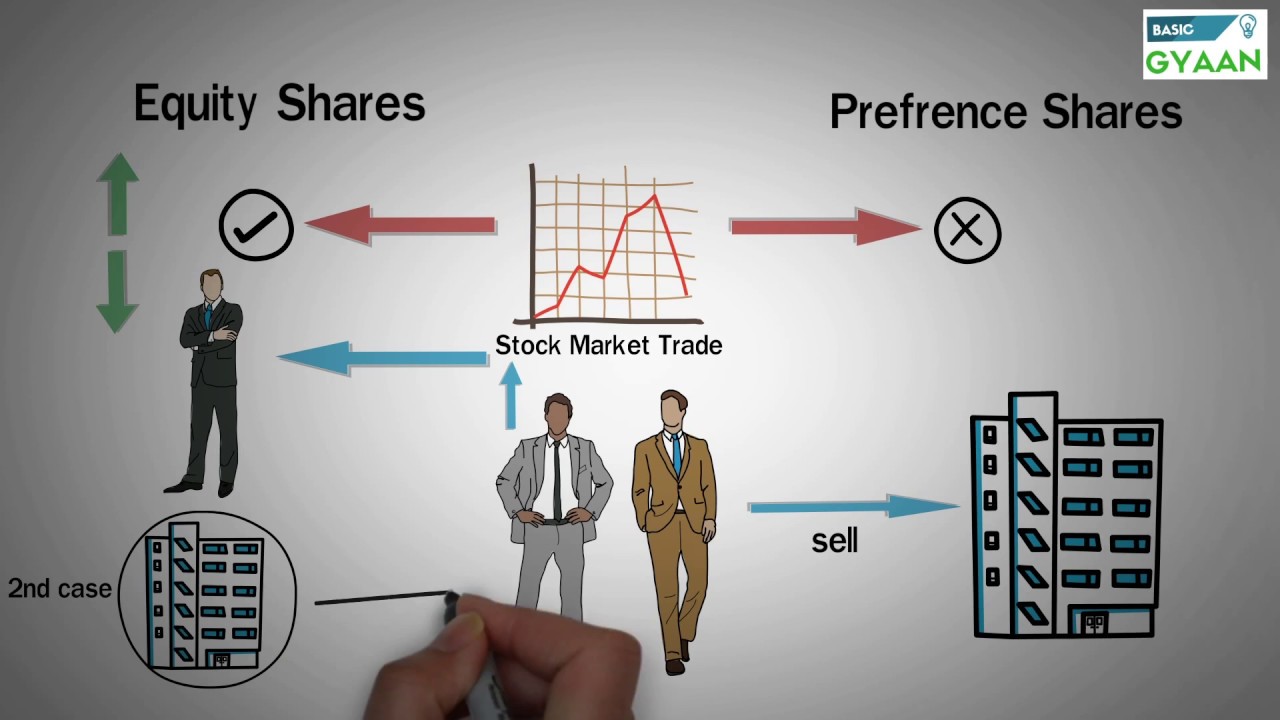

How to sell preference shares. You will have to sell your shares to any. Preference shares can be repurchased by the company at a specific price on a specific date. Investors generally have the right to buy and sell preferred shares in the public or private stock markets.

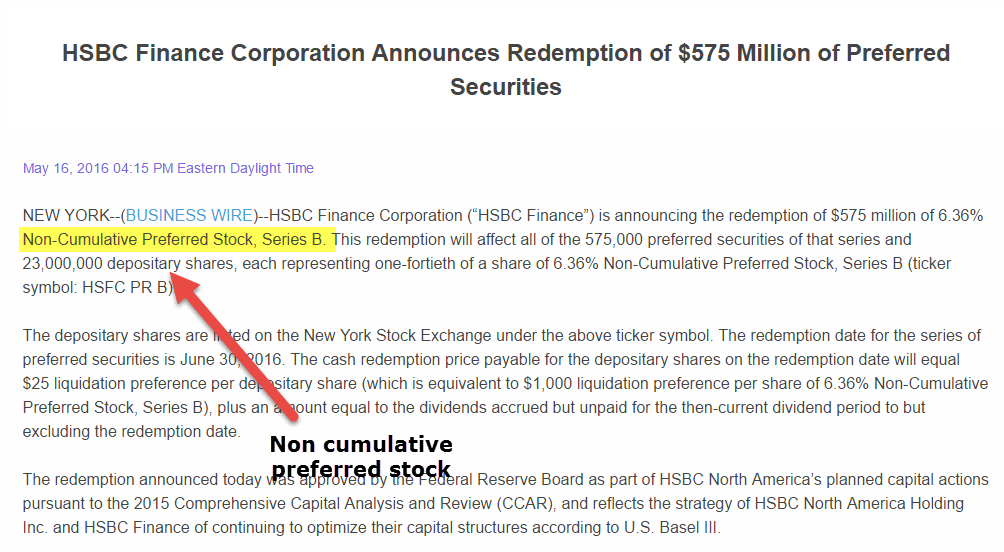

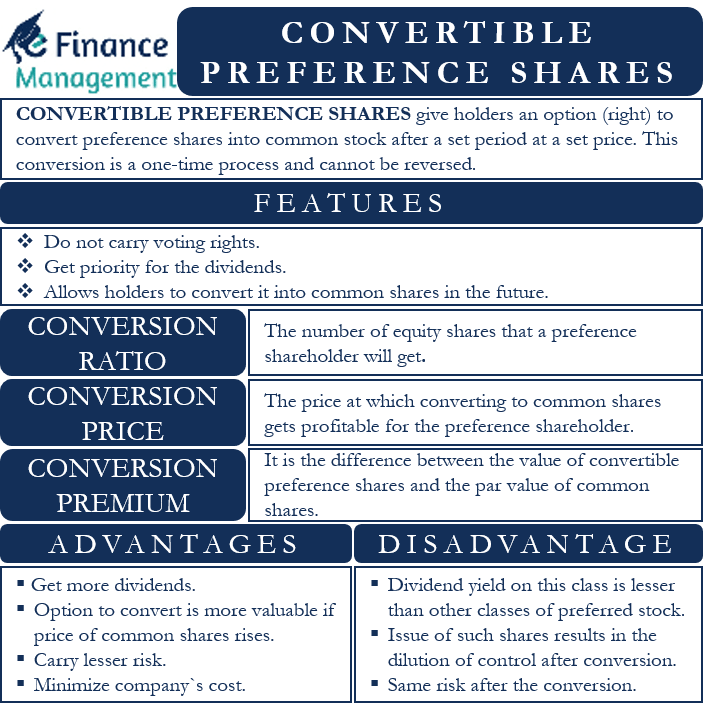

Ad everything you need to know about the private market. You can't do that with ordinary shares. Preference shares may be converted to common shares depending on a pre.

That's over two years' worth of dividend income (8.1. In most cases, the easiest option is to sell your shares of stock back to the company that issued them. Preferred stock is a very flexible type of security.

The formula for determining the value of the share at the present time can be written as follows: They are used by professional and private investors who prefer a. Amc theatres to sell up to 425 million “ape” preferred shares.

Invesco preferred etf stock performance. Giant theater chain amc entertainment filed today to sell up to 425 million amc preferred equity units, or apes, its new securities that. It is obvious from the equation that the present value of the share is equal.

Selling preference shares most preference shares, if you hold them until their maturity date, will be converted into ordinary shares, usually at a discount to the market price at the time. I have some northern electric preference shares, which i got years ago, if i recall as a free gift as i owned normal normal electric shares at the time. The company may also repurchase shares at the current market price if.

:max_bytes(150000):strip_icc():gifv()/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)

/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)

/GettyImages-968680446-c87f6b0ea56748e2bdc73dfb4f96b688.jpg)

/GettyImages-145054296-879801119de145a9a2fb72a761ece809.jpg)

/ThinkstockPhotos-474982979-5c6c7c5146e0fb0001719807.jpg)