Exemplary Tips About How To Reduce Receivables

Divide that number by two to get your average accounts receivable total.

How to reduce receivables. This sends a strong signal to the client that you are serious. How can you reduce outstanding receivables? When you sit down and fully calculate your accounts receivable expenses, the number can be surprisingly large.

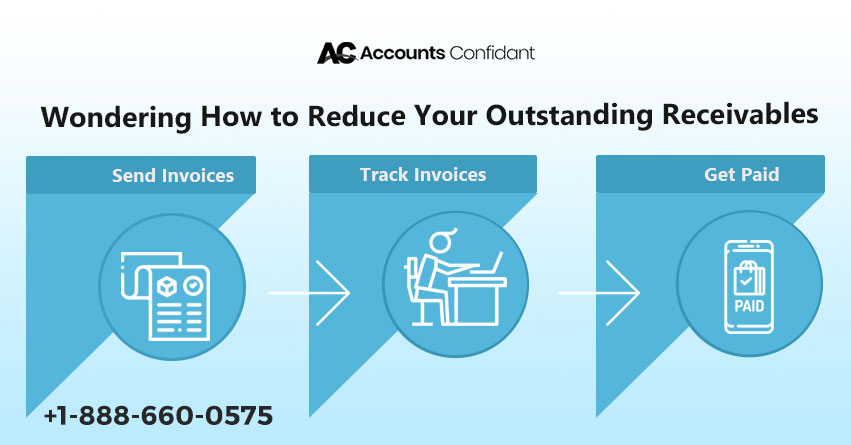

You can also ask for payment of any recovery fees, including legal fees, if the account is not paid. Early payment discounts encourage customers to pay an invoice before its due date. Accounts receivable processes should be automated as much as possible to reduce the risk of errors from manual entry.

11 tips to improve your accounts receivable turnover 1. In order to reduce accounts receivable expenses and start. For small businesses that fight to squeeze every dollar out of their customers and often receive payments days or weeks after.

Sending simple reminder emails at regular intervals like every 15 days is also a great way to keep reminding customers of their. Segregate the duties of your employees. Offering small incentives on early payoffs can help businesses get quick payments with decreased customer costs.

Add the accounts receivable total at the beginning of the six months and at the end of the six months. Fortunately, there’s a fairly simple way to address receivables fraud risk: The first rule of thumb with accounts receivable is to establish strong client.

Scheduling regular reminders, sending simple reminder. Ask for interest if it's not paid within your terms. Reducing your msp’s aging accounts receivables is not impossible, but it does require some planning to see results.

![Save The Planet — Automate Your Accounts Receivable [Infographic]](https://24dlmn2bqamt1e72kah59881-wpengine.netdna-ssl.com/wp-content/uploads/2021/04/infographic_earthday_4_2021_final.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_should_investors_interpret_accounts_receivable_information_on_a_companys_balance_sheet_Apr_2020-01-93d387c085e04ab4bf99fa38dcdfd48d.jpg)