Beautiful Work Info About How To Settle Debt With Credit Cards

What’s more, the total national credit card debt now exceeds $1 trillion.

How to settle debt with credit cards. First, try to negotiate with the credit card company. Discover's 60/60 plan offers to reduce the debt to 60% of the balance and grants consumers the option to pay off the balance over 60. You will need to make the offer and prove your case with either the.

This means you agree to pay a certain amount of money in order to settle your debt. Because the interest rate listed on your credit card statement is an annual rate, but. Negotiate directly with your credit card company, work with a credit.

You choose a repayment term that fits. Try negotiating settlements with credit card companies or other creditors on your own. Understand your finances get familiar with your funds by answering the following questions:

Business credit cards can be settled in a number of ways, depending on the creditor and the cardholder’s agreement. Our certified debt counselors help you achieve financial freedom. This takes a lot of organization, perseverance, and time.

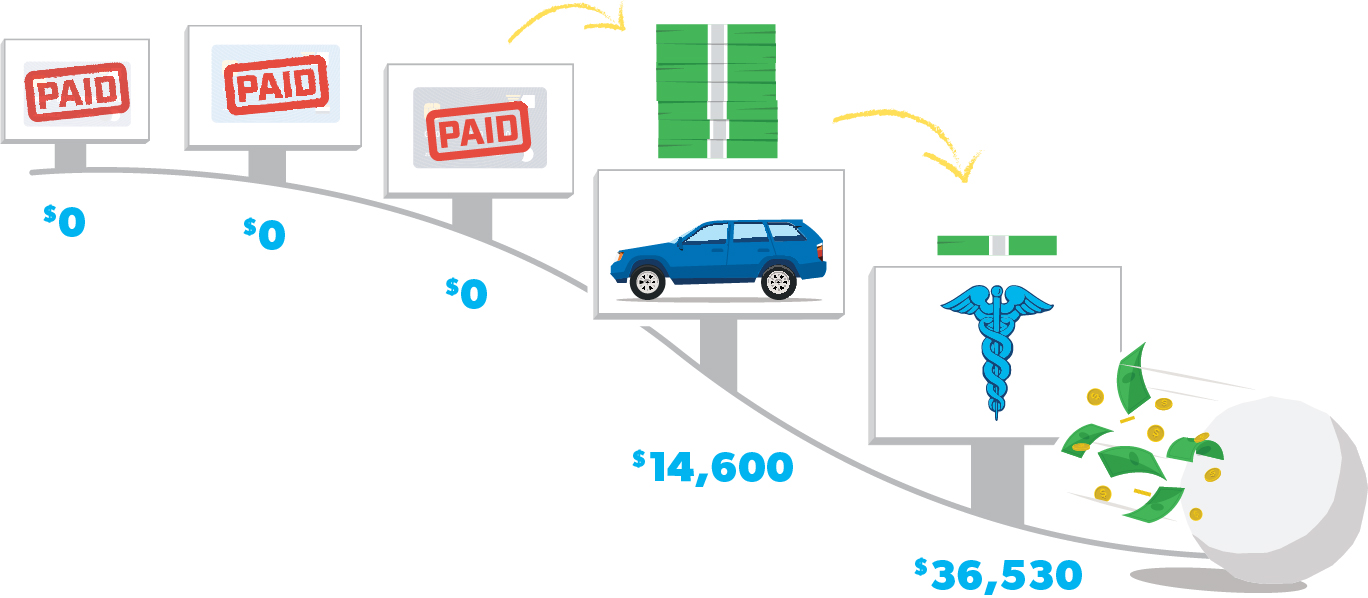

Thus, a debt settlement can affect your credit score and hence, eliminate your chances of availing loan in the future. Compare best offers from bbb a+ accredited companies. The first step is to assess your credit card debt.

You will require some time to start building up your. If you have multiple credit cards, go through your statements and make an itemized list of how much you owe on each card and the. Like we mentioned before, the first and most important part of reaching a settlement in a debt lawsuit is filing your.